BOAO, Hainan, April 11 (Xinhua) -- China's central bank governor on Wednesday fleshed out measures and disclosed a timetable to further open up the financial sector, signaling fast progress in implementing the country's opening-up promises.

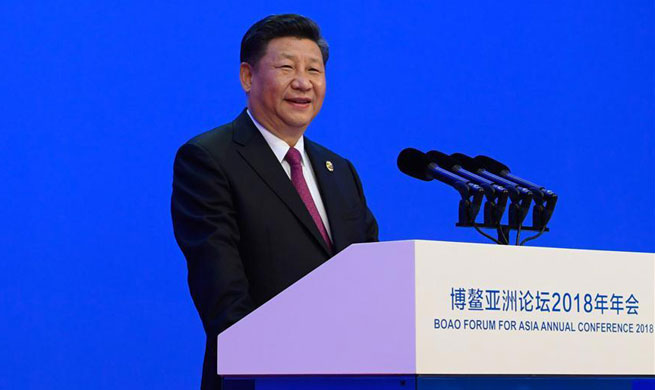

China will encourage foreign investors to enter its trust, financial leasing, auto finance, money brokerage and consumer finance sectors, a move to take effect before the end of this year, said Yi Gang, governor of the People's Bank of China, at the Boao Forum for Asia annual conference in the southern Hainan Province.

No foreign ownership limits will be set for new financial asset investment and wealth management companies initiated by commercial banks, he said.

China will also "substantially expand the business scope of foreign banks," and impose no restrictions on the business scope of joint-venture securities companies, Yi said.

In addition, the country will remove the requirement that foreign insurance companies must have had representative offices for two years before they set up businesses in China, he said.

All these measures will come into force before the end of this year, Yi told a panel discussion, noting that the country will also try to launch the Shanghai-London stock connect program within this year.

The opening policies in the following six areas will be implemented in the coming months, according to the governor.

First, foreign equity restrictions on banks and financial asset management firms will be canceled, with equal treatment for domestic and foreign-funded institutions. Foreign banks will be allowed to set up branches and subsidiaries at the same time in the country.

Second, foreign businesses will be allowed to own up to 51 percent of shares in securities, funds, futures and life insurance joint ventures, and the cap will be phased out over three years.

Third, securities joint ventures will not be required to have at least one securities firm among its domestic shareholders.

Fourth, daily quotas for the stock connect schemes between the mainland and Hong Kong will be quadrupled starting from May 1. The daily southbound quotas for the Shanghai-Hong Kong and Shenzhen-Hong Kong stock connects will be increased to 42 billion yuan (about 6.67 billion U.S. dollars), while the daily northbound quota will reach 52 billion yuan.

Fifth, qualified foreign investors will be allowed to operate as insurance agents and appraisers in the country.

Sixth, foreign-funded insurance brokers will have the same business scope as their Chinese counterparts do.

The central bank governor stressed equal treatment of domestic and foreign companies. "Their performance and competitiveness are up to themselves. The market is open," he said.

The opening up of the financial sector should go together with the reform in exchange rate formation mechanism and the process of advancing capital account convertibility, Yi said.

While mapping out the plan of opening up, the governor also called for attention to financial regulation.

"While pursuing opening up, we should attach importance to preventing financial risks," he said. "The capability of financial regulation should match the extent of opening-up."